Why UK holiday rentals are still a very good bet

On June 23, the day that Boris announced July 4 as the date for the easing of lockdown in England, Sykes Holiday Cottages, the UK’s leading and fastest-growing independent holiday

cottage rental agency, registered over 276,000 sessions on its booking platform and took a staggering 400 real-time bookings each hour.

Sykes was not alone in this surge. According to a report in the Telegraph Travel, holiday rental bookings have quadrupled across popular UK destinations with many of us keen to have some respite from being stuck at home for the last three months. Andrew Easton, managing director of Cornwall-based self-catering cottage company Beach Retreats, said: “The past few weeks, since July 4 was mooted, have been like nothing I have seen in 15 years. We have seen record numbers of bookings for the summer, autumn and 2021. We’re practically full for July and August, while September and October are well ahead of last year’s occupancy levels.” Continue reading

Student housing giant looks to continue rapid growth

Unite – one of the largest providers of student beds in the UK – recently announced the successful completion of the placing it carried out, raising gross proceeds of around £300 million.

Placing Shares were issued at a price of 870 pence per share, with the placing price representing a discount of 3.1% to the middle market closing price on June 24 2020 of 897.5 pence.

A total of 34,482,759 new ordinary shares were placed at a price of 870 pence per share. Concurrently with the placing, certain directors of the company subscribed for an aggregate of 20,113 new ordinary shares in the capital of the company at the placing price, raising gross proceeds of around £175,000. Overall, the issued shares account for approximately 9.5% of Unite’s issued ordinary share capital prior to the placing. Continue reading

Old Kent Road scheme gets the go-ahead from Southwark Council

The green light has been given by Southwark Council to developers Avanton and Urban & Provincial for the £130 million (GDV) redevelopment of a former Carpetright warehouse.

The warehouse, located at 651 Old Kent Road, will be transformed into new homes, of which 40% are set to be affordable housing. Developed in partnership by Avanton and Urban & Provincial, the Carpetright scheme is set to deliver 262 homes, including 170 for private sale, and 20,000 sq ft of commercial space on the ground floor of the buildings, designed around three large outdoor spaces. Continue reading

Property market back with a bang as Rightmove records busiest ever day

Since being allowed to officially reopen on May 13, the property market has returned with a bang, according to Rightmove.

The property portal reports that last Wednesday, May 27, it recorded its busiest ever day, with over six million visits – up 18% on the same Wednesday in 2019.

It says that eager property searchers are starting to act as record levels of buyers phoning and emailing estate agents were also recorded. Continue reading

How is Scotland’s property market adapting to social distancing measures?

With the new restrictions on daily life imposed by the UK government, several buyers still want to make property purchases despite the uncertainty, according to Edinburgh-based real estate consultant ESPC. Across the country, social distancing measures have been introduced in workplaces, essential shops, supermarkets and even households as the country tries to limit the spread

of Covid-19. Continue reading

Coronavirus impact – property owners shifting from short to long-term letting

The Covid-19 outbreak has impacted all industries, including the whole of the property sector, but the short-lets market has perhaps been harder hit than most thanks to the restrictions on travel, holidays and business trips. As a result, property owners are shifting from short to long-term letting as the coronavirus hits holiday lets, according to Apropos by DJ Alexander. The property management company says it has first-hand evidence of Airbnb owners moving their properties away from holiday letting to long-term letting as the tourist market collapses. Continue reading

Coronavirus impact – is the short-lets market in serious trouble?

The results of a poll conducted by the UK’s short-lets trade body with its corporate membership has revealed just how damaging Covid-19 has been when it comes to companies’ reservations and income.

The feedback the UK Short Term Accommodation Association (STAA) received from its corporate members, representing the majority of the short-let industry, highlighted some very stark issues.

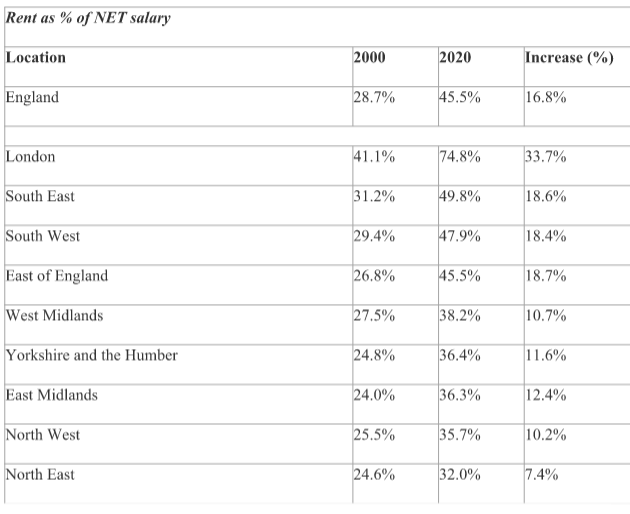

Income required to rent in parts of England – a 20-year review

The amount of net income required to cover the cost of renting has increased 16.8% in the last two decades to 45.5% nationally – now accounting for 74.8% of the average salary in London.

That is according to the latest research by sales and lettings agent Benham and Reeves, which found that the average rent accounted for 28.7% of the average income in England 20 years ago.

This was higher in the capital, where 41.1% of income was required to cover rent, with the South East (31.2%) and South West (29.4%) also amongst some of the highest of all regions. The proportion of income required to cover the cost of renting has increased by 16.8% across England to 45.5%. Again, the analysis shows London has seen the most drastic increase with a whopping 74.8% of the average income now required to cover the average cost of renting – a 33.7% increase since the turn of the millennium. Continue reading

Could living near a landmark increase the value of your home?

The London Eye, Spinnaker Tower and Warwick Castle – all recognisable UK landmarks with a wealth of history behind them, but does living near some of the country’s notable landmarks increase the value of a home when it comes to selling? Continue reading

2020: The drive towards more tenant-friendly regulation

The past decade has seen many companies that converge property portfolios, hospitality and travel benefit from an unprecedented pace of growth.

Landlords have long been sat at the head of the table, with the market enabling them to best capitalise on and diversify short-term rental demand across their portfolios. As we head into 2020, however, the market will see a notable shift to better ensure tenants are also given a seat at the table. With change comes complications, though if armed and prepared, the result can usher in a new and improved trajectory.

Regulatory changes are poised to shake up the UK property market in the year ahead, heralding in a new benchmark for the future of landlords. To help assess how to survive, thrive and turn a profit in 2020 and beyond, here is a deep dive into the regulation that lies ahead…

Tenants to be freed from fees

From June 1 2020, The Tenant Fees Act will apply to all private shorthold tenancies, including those entered before June 2019 when the Act was first introduced. This legislation was designed to restrict the type of fees landlords and letting agents could charge tenants, meaning costs such as check-out fees are no longer enforceable by law.

The push towards banning letting fees comes as no surprise given that, for some time now, tenants have been tasked with paying fees that solely benefit landlords. A key focus for landlords and letting management services should be to ensure that clauses in older agreements will accurately reflect shorthold tenancies. Another core component of this Act for landlords to take note of involves deposits now being capped at five weeks’ rent, or six weeks’ rent on tenancies where the annual rent exceeds £50,000. While existing agreements are still applicable, landlords will need to

reduce deposits to be in line with legislation before the tenancy renews and certainly before June 1.

Bringing all deposits in line with legislation well in advance will help landlords avoid fines ranging from £5,000 to £30,000. Failure to comply isn’t in your back pocket’s best favour.

Existing letting management services will turn to tech solutions to ensure landlords are able to effectively monitor and adapt to regulatory changes.

Fit for a king

Falling short on quality is no longer an option. While The Homes (Fitness for Human Habitation) Act is not new to landlords, it will see a heftier addition on March 20 this year. All existing tenancy agreements will now become subject to the Act. While buy-to-let properties may not have traditionally been the focus under this new Act, they will have to ensure they meet the correct standards or risk facing a claim larger than the required repair.

Up until now, the ability to get away with significant flaws or substandard offerings was easier, particularly in London where demand for short-term lets is especially high. With the reality now changing course, landlords must pledge to improve the quality and consistency of tenant experience.

With the spotlight now sharply on landlords to deliver, the pressure of looming deadlines and repair requirements can be a struggle to manage alone. With the help of an integrated management service, advice and support will provide not only how to adhere to the Act but how best to optimise space and the repairs able to stand the test of time and taste.

Efficient energy or else

From April 1 2020, The ‘Minimum Energy Efficiency Standards’ (MEES) will see some additions come into effect. Landlords with residential properties let on existing shorthold or fully assured tenancies must improve their rating to E- by April 1 otherwise an exemption is filed.

The penalties for renting out a property that fails to meet the rating for up to three months will be met with fines up to £5,000 and those over three months may be fined up to £10,000. It won’t stop there, those that provide false or misleading information will also face a £5,000 fine. It is important however to bear in mind that landlords can still legally avoid the regulations if certain special circumstances apply. For one, if landlords can prove that installing energy efficiency measures reduces the value of their property by 5% or more, they can be exempt.

A six-month respite is also on the table for those that have recently become the owner of a rental property.

Buy-to-let set for a bright future

As the introduction of more tenant-friendly regulation picks up momentum, landlords will have to adapt to become more strategic in their portfolio approach. Though this doesn’t necessarily mean the division between landlord and tenant needs to further widen. Instead, it can be an opportunity for all parties to see what can be done to make the market more attractive.

Landlords with multiple properties can effectively tap into or enhance their portfolio in this new landscape with a well-targeted and responsive management service to enable them to optimise their yields across short, medium and long-term lets. Change might be on the horizon, but one thing is for sure, the next decade will see a healthier balance of treatment between tenants and landlords. Property players will move towards a new chessboard strategy and the resources available to help navigate that change in growth are raring to go.