Living costs crisis is upon us, but resi property will always weather the storm

This time last year, amid frenzied activity in the residential property market in Scotland, driven by the unprecedented external factors of which we are all aware, I suggested that a levelling out and a return to more normal conditions might not be a bad development.

Short lease hotspots – what are the pros and cons for investors?

The regions of England and Wales home to the least time remaining to renew when it comes to properties listed for sale with a short lease have been revealed by Warwick Estates.

The market analysis examined short lease homes listed for sale, with a short lease being anything less than 80 years, before calculating the average lease years remaining for short lease homes.

The average number of remaining years for short-lease homes currently for sale is 42.2, across England and Wales. Continue reading

Staycations here to stay – holiday owners set for another record-breaking year

Following record-breaking years for staycations in 2020 and 2021, with people urged to stay local as a result of the pandemic – or prevented from going abroad by travel restrictions – 2022 looks set to be another excellent year for holiday let owners.

Despite travel restrictions easing across the globe, UK holiday let owners are preparing for another busy year as bookings for staycations continue to surpass pre-pandemic levels. That’s according to holiday home rental agency Sykes Holiday Cottages, which has revealed that bookings so far this year are up 22% versus the same point in 2020. What’s more, there has been a 158% rise in bookings compared to the same period last year. Continue reading

Knight Frank – post-Christmas supply builds as Omicron uncertainty fades

The lifting of Covid restrictions recently could see the supply of property rebuild and normal house price economics return, according to leading property consultancy Knight Frank.

“What happens in the property market in the first two weeks of the year is often a useful barometer for the next six months,” Tom Bill, Head of UK Residential Research at Knight Frank. “We can gauge the appetite of buyers and sellers who have spent the Christmas holiday contemplating their next move.”

He said this year also comes with the caveat of Omicron, with initial jitters about its impact subsiding in recent weeks. “Looking at the data for the first ten working days of January, a few patterns are clear,” Bill said. “The first conclusion to draw is that supply will build. Explanations for the gravity-defying house price growth seen during the pandemic have often centred on the ‘race for space’, accumulated household savings and the stamp duty holiday.” He added: “The less eye-catching and arguably more important fact that supply has been tight is often overlooked, although the RICS has been flagging the issue for months. As the ever-sensible equity analyst Kevin Cammack of Cenkos Securities wrote last week: 'Normal house price economics are out of the window until the supply side improves.” So, to what extent has supply been building in early January?

Knight Frank says the answer to that question is “tentatively”, as the below chart demonstrates.

Bill says market valuation appraisals are a leading indicator of supply and the UK figure was 9% higher than the five-year average. “Indeed, compared to the same period last year (when the country was locking down), the figure was up by 48% and was last higher in 2016. It was a similar trend across all parts of the country,” he explained. “However, the number of new sales instructions was still down by a quarter. The drop was lower in London, which can be explained by lower seasonality in a market where owners are less likely to wait for spring before listing. It also underlines how the London property market is very much in bounce-back mode as the economic epicentre of the country re-opens. The number of offers accepted in the capital in November was the highest it has been in ten years, Knight Frank data shows.”

Bill adds that new demand in the capital is also out-pacing regional UK markets, with the number of new prospective buyers 67% higher than the five-year average. In markets outside of the capital, the increase was 52%. Knight Frank recently explored why demand might not remain so high throughout the year. In summary, demand continues to outweigh supply but there are signs of a reversal, Bill concludes. “We have made the same observation before, but that was before Omicron. If the lifting of restrictions this week begins to feel permanent, supply is likely to normalise. Until then, normal house price economics are likely to remain elusive.”

Half of UK renters want to buy out their landlord – study

A significant proportion of those renting a home would like to buy it from their landlord if circumstances allowed, new research by Gradual Homeownership provider Wayhome shows.

In a national survey of 4,002 people, carried out by Opinium, 42% of tenants said they would like to buy their current rental home, if it were feasible. This rises to 45% of private renters compared to 38% of social tenants.

Interest peaks between the ages of 25 and 34, with more than half of tenants keen to buy the home they’re currently living in. This compares to just under one-in-three of those aged between 65 and 74 (32%), the age group least motivated to buy out their landlord. Regionally, London sees the highest proportion of tenants keen to buy their current home at 53%. This is followed by those in Yorkshire and Humberside (46%) and those in the South East of England (44%). Those in the North East (30%) are least likely to want to buy their home.

There are several factors that drive the desire of tenants to buy out their landlord, with the home’s location topping the list (51%). Half (50%) say it’s because they ‘love’ the home and 38% say it’s because they don’t want the hassle of moving.

Top reasons why tenants want to buy the home they currently rent:

Reason

Good location

Love the property

Want to avoid hassle of moving

Spend money furnishing the property

Close to family/friends

The property suits my needs

Percentage

51%

50%

38%

36%

35%

21%

Meanwhile, a quarter of homeowners (26%) say they would have considered buying the last home they rented if it would have been possible at the time.

Meanwhile, a quarter of homeowners (26%) say they would have considered buying the last home they rented if it would have been possible at the time.

Wayhome says in reality, most UK tenants wanting to buy the property they rent in today’s market face tough challenges. When applying for a mortgage, a first-time buyer will be approved for 3.55 times their gross household income1. When the average UK income of £47,662 is considered, it can leave those buying on their own with a mortgage worth as little as £169,200.

Even if their landlord were happy to sell, the strict lending criteria enforced by the high street banks severely limits their chances of securing a mortgage sizeable enough to buy the property. Wayhome, which could help tenants buy their home from a willing landlord, warns that the property market needs to adapt to enable more people to get onto the housing ladder.

Chief executive officer Nigel Purves comments: “It is clear from this research that renters in the UK want to have more of a stake in their home. But with prices going up, mortgage affordability becomes more constrained than ever, which makes getting on the ladder an increasingly distant dream.”

Investors – could this be the time to consider investing in Scotland?

Investors could help to plug the shortage of private rented properties in Scotland, which is in desperate need of new supply. Continue reading

What is the top UK market trend from an Asian investment viewpoint?

Wealthy Chinese investors have long been reliable investors in the market, and have frequently looked to the UK, specifically London, as a stable and reliable point for investment.

Twice as many homes were sold in Central London for more than £15 million in 2021 as in 2020, the latest figures revealed, and it is anticipated that Russian and Chinese buyers will lead the way in the capital in 2022. But, from a Chinese and Asian investment perspective, what is set to be the number one trend in the UK residential property market in 2022? Continue reading

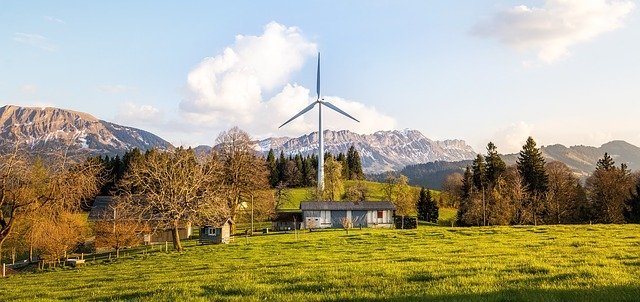

Revealed – do homeowners take energy efficiency seriously?

A recent survey has revealed that only one in eight (13%) people in the UK admit that they seriously considered the energy efficiency of their home when they bought it. Continue reading

Planning reform the biggest obstacle for residential development – claim

The existing planning system is the biggest obstacle to residential development, according to national property consultancy Lambert Smith Hampton (LSH).

Its annual Residential Development Survey – which canvassed the views of housebuilders, developers, investors, professional services and public sector bodies – reveals that 68% identified the “challenging, time consuming and costly” system as the top issue facing the delivery of new homes. Continue reading

Will 2022 be the time to invest in property?

Another new year is approaching, but unlike the last, 2022 should arrive with significantly less uncertainty, especially for the property market. Not only did the initial stamp duty deadline present the possibility of a crash in property prices for 2021, but the ongoing Covid-19 uncertainty made for a bleak economic forecast. Continue reading